About Us

Budgeting Approaches -Preparation

The budget process was described in the Budgeting section as the way an organization goes about building its budget. In this, the first of a four-part series on good budgeting approaches, we begin with preparing to budget.

Confirm your budget's relationship to your mission and long range/strategic and financial goals.

One of the very first tasks listed in the budget process section of this website is "Review mission and strategic plan" with the note to "Ensure that all strategic initiatives with budget impact are included in budget process." Jody Blazek says that “A budget is the numerical expression of an organization’s dreams that serves as a guide or measure of acceptable financial performance.” An organization's budget can and should demonstrate its commitment to its mission and sustainability through numbers. This requires answering questions such as:

• Did conversations take place among board and staff to agree on budget priorities for the coming year? Are resources allocated in the expense budget in a way that reflects the mission priorities and financial goals of the organization

• Is the organization being pulled off course by going after grants or special project opportunities just because they are available, even if they don't support identified mission priorities?

• Was there an assessment of your current programs? Was there a break-even analysis done to determine whether or how much subsidy is needed for each program? If you are implementing programs that are not high mission priorities, are they at least contributing substantially to financially support the organization

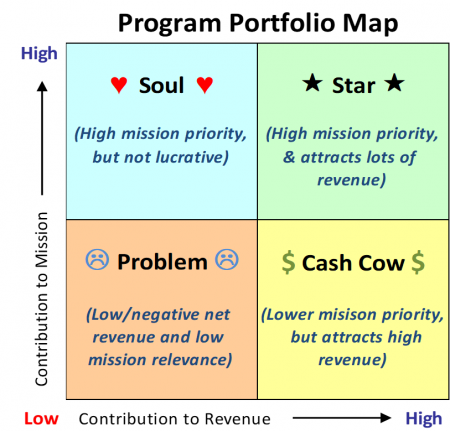

As a simple exercise to stimulate discussion, plot your organization's programs on a Program Portfolio Map, prototype shown in the illustration below.

As long as there is some mission relevance, so called cash cows can support heart & soul programs, but for any that fall in the "problem" area, an organization may want to examine whether that program should be continued.

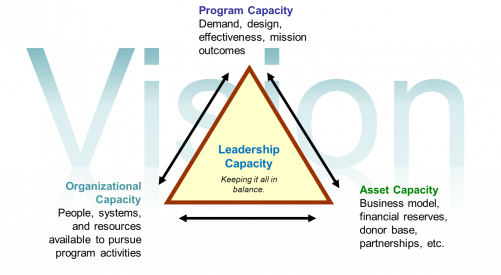

Such generative discussions among board, staff, and stakeholders allow the organization to be intentional about the kind of an organization it wants to be. What is necessary to achieve a stable, healthy, mission-driven nonprofit? Have we budgeted for adequate financial flexibility? Do all staff have the needed skills? Are compensation packages fair and reasonable? What financial position will allow us to seize opportunities? What lessons learned would apply to the upcoming budgeting process? What particular challenges are we facing?

Having these open and energizing conversations about the fundamental capacities of the organization will position staff and board to proceed with the budgeting process with clear goals and expectations in service of the organization’s unconditional reason for being.

Prepare Your Accounting Structure

It may seem to go without saying but starting with a solid accounting structure provides the foundation for successful budgeting and, in turn, accurate reporting on performance to budget. It is vitally important that your budget line items and activity classes align exactly with the accounting system’s chart of accounts and activity classes or cost centers. Please see “Chart of Accounts for Small and Midsize Nonprofit Organizations” elsewhere on this website plus detail resources to help you to either set up, or to assess and potentially update, your accounting line items and classes as you construct your budget workbook:

Return to the Budgeting & Financial Planning Introduction page for other content and downloadable resources pertaining to budgeting.