About Us

The Statement of Activities

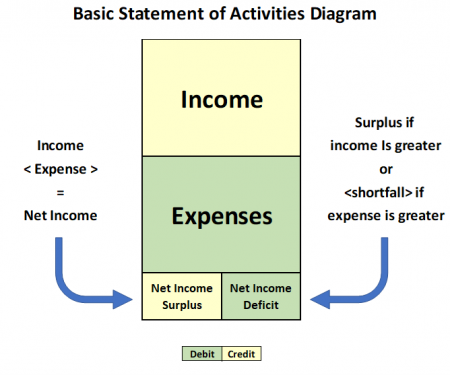

The Statement of Activities (SOA) is the correct nonprofit term for the report we may commonly have called the income statement, budget report, profit & loss, income and expense report, etc. The SOA report shows a nonprofit organization’s income, expenses, and net income for a specific period of time, all or part of a fiscal year. The report reflects the changes to an organization’s net assets resulting from financial activities that occurred during the fiscal year.

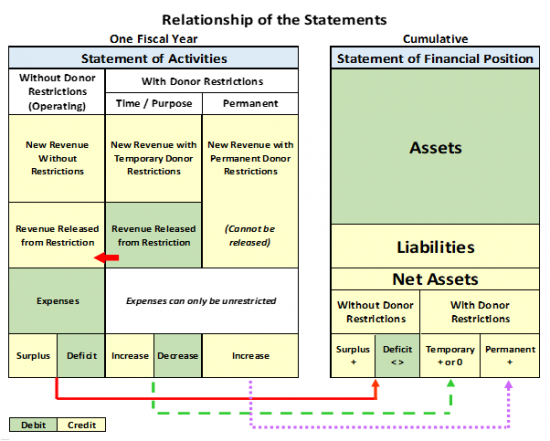

Financial activities result in either a surplus (increase) or shortfall/deficit (decrease) in the organization’s net assets shown on the Statement of Financial Position (SOFP). Net results are classified as either with or without donor restrictions per FASB (the Financial Accounting Standards Board). For internal accounting purposes, an organization may track these designations in more detail to differentiate among net assets without donor restrictions, in addition to separating net assets with donor restrictions between temporary or permanent classifications. The result of each year’s financial activity is shown as the “change in net assets,” that is, increases or decreases to the related net assets categories. The relationship of the SOA to the SOFP is shown in the illustration below.

The results of each successive fiscal year’s financial activities accumulate on the SOFP, changing the net asset balances. Repeated annual deficits in the SOA will result in an accumulated deficit on the SOFP. Consistent annual surpluses are, of course, preferable. Net assets with donor restrictions are usually never below zero, although special reporting may apply to an “underwater ” endowment balance (topic not covered here).

Return to the Internal Reports Introduction page for links to greater detail on how to read various reports as well as recommended formatting.