About Us

Chart of Accounts-Assets

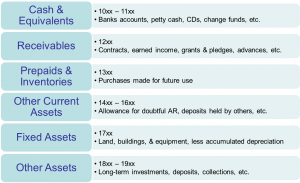

Assets accounts reflect what you have (cash, investments, fixed assets), what others might owe to you (receivables, deposits), or what you might have invested for the future (prepaids, inventories). For small and midsize nonprofits without overly complex systems, 4-digit account numbers are usually adequate. Longer numbers can certainly be used, but that requires more keystrokes and may be harder to remember. Assets account numbering usually begins with 1.

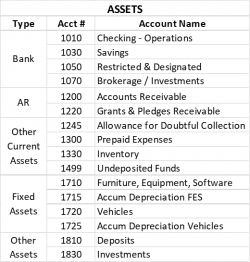

Here is a sample set of Asset accounts for a small-midsize organization:

• Checking and regular savings are for day-to-day working capital.

• Your board policy may call for keeping board-designated and funds with donor restrictions in a separate savings account or money market.

• If your organization accepts donations of stock, you may need to have a brokerage account to accept and handle them per your board’s policy.

• A small organization may need only one receivables account; two might be used to separately track receivables from program revenue activities vs. from contributions.

• An allowance for doubtful account might apply to multi-year pledges that have some risk of being uncollectible. Your accountant can assist with determining this amount.

• An account to record the discounts on pledges due in over a year should be set up as a contra account.

• Prepaid and inventory expenses are purchases of goods or services that will be used in a future period and that are paid for in advance.

• Undeposited funds is a common software utility account that holds deposits from the time payments are received to the time the funds are actually deposited in the bank.

• Fixed assets comprise furniture, equipment, software, vehicles, etc. that cost more than a certain amount and have a useful life of more than one year. The “certain amount” is established by the board as a capitalization threshold. Under that threshold, purchases are fully expensed in the current year. Otherwise, the fixed asset is depreciated (i.e., the expense is divided) over the number of years estimated as its useful life.

• Deposits are advance payments made by the organization such as for rent deposits or utilities that are ultimately refundable, but that are not ready cash.

• Investments (as “other” or “long-term” assets) may include longer-term endowment funds, if applicable.

Your accountant will know which of these accounts you actually need, and whether additional asset accounts may need to be added. See also: Sample COA ~ Small-midsize Nonprofits below.

© 2021 Elizabeth Hamilton Foley

This information is provided for small and midsize nonprofit organizations for educational purposes only. It is not comprehensive and should not be considered legal or accounting advice on any specific matter. The user of this template/sample is responsible for tailoring the contents to meet the specific needs and circumstances of the organization.