Nonprofit Accounting Basics

Mastering Timekeeping and Compensation for Federal Awards: Key Requirements and Best Practices

Organizations employ various methods, ranging from Excel spreadsheets to sophisticated timekeeping software, to track and report employee time. Tracking and reporting employee time is essential, particularly for organizations with federal awards. To ensure compliance and efficiency, maintaining a timekeeping policy is recommended and required to ensure the allowability of compensation and fringe benefits. The requirements around time and effort reporting may vary based on the award type (i.e., a contract or a cooperative agreement). While all federal funding is subject to the Uniform Guidance(1), federal contracts are also subject to the Federal Acquisition Regulation(2). These simplified guidelines on time and effort reporting, including key considerations for compensation and fringe benefits, will provide much needed clarity.

Time Keeping

To comply with federal requirements, employees must accurately record their time, distinguishing between awards and internal activities. It is crucial to establish a well-defined timekeeping policy that includes a consistent timesheet submission process supported by documented procedures. This policy should apply to all organizational activities, not solely the federally funded portion. Tracking 100% of employee time each day is necessary, encompassing all aspects, including those not subject to federal funding. A best practice is for employees to submit their time sheets for approval by their supervisor.

The Uniform Guidance permits time allocation based on budget estimates, but only on an interim basis with appropriate controls to ensure accuracy. If operating under a contract, the Federal Acquisition Regulation requires time to be allocated to individual awards based on actual hours spent. Allocating time based on actual hours from the beginning of all awards reduces the need for extensive documentation and review of budget estimates in the long term.

Accurate time allocation is crucial for federal award compliance, ensuring payment only for activities that align with their purpose. Given that compensation and related fringe benefits are often significant expenses, it is essential to allocate time accurately.

Compensation

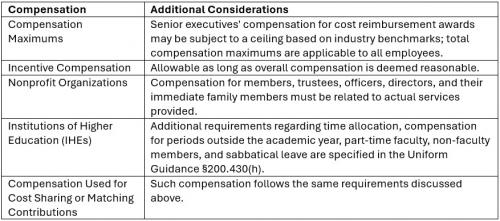

Compensation, encompassing all remuneration for an employee's service during the award period, should adhere to internal policies and market rates for similar work. It is important to note that receiving payment for work performed does not automatically make it an allowable cost on the award. Specific considerations for compensation to remain in compliance with the Uniform Guidance §200.4301 include:

Federal funding subject to the Federal Acquisition Regulation2 requires owners, members, partners, and members of their immediate families to receive compensation solely for services performed. Retroactive pay, or backpay is generally unallowable unless certain conditions are met.

Fringe Benefits

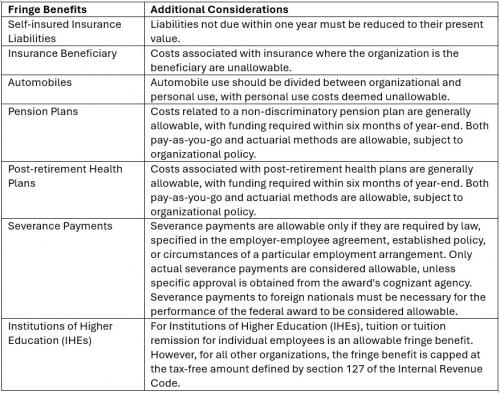

Compensation costs related to leave, such as sick, vacation, and holiday, can be allocated as fringe benefits to the federal award if outlined in the organization's written policy. These benefits should be allocated proportionally to all activities, not solely to federal awards. Without a written policy, these costs are not considered allowable direct costs. Considerations for fringe benefits to remain in compliance with the Uniform Guidance §200.4311 include:

Federal funding subject to the Federal Acquisition Regulation2 has increased requirements around pension plans, post-retirement health plans, and other post-retirement benefits.

Summary

Effective time and effort reporting for federal awards requires organizations to establish and follow robust timekeeping and leave policies. Accurate time allocation, considering both budget estimates and actual hours spent, is crucial for compliance. Organizations should adhere to compensation limits and industry-specific considerations to ensure allowable costs. A proportional allocation of fringe benefits across all organizational activities is essential. By implementing these practices and reviewing current compensation and fringe benefits, organizations can successfully navigate the complexity of time and effort reporting for federal awards.

(1)A detailed discussion of compensation requirements for all federal funding, including time tracking, is in §200.430 - §200.431 of the Uniform Guidance.

(2)A detailed discussion of compensation requirements for federal contracts is in §31.205-6 of the Federal Acquisition Regulation.